Solutions

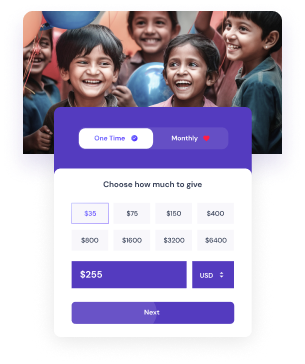

Create unlimited donation forms designed to delight donors.

Create Multiple Variations & Simply add your button design.

Create unlimited donation forms designed to delight donors.

Create Multiple Variations & Simply add your button design.

Create unlimited donation forms designed to delight donors.

Create Multiple Variations & Simply add your button design.

Create Multiple Variations & Simply add your button design.

Optimize donations with our powerful WordPress plugin.

This post is also available in: Español (Spanish)

Join Our Newsletter

Be the first to know about our latest updates, exclusive offers, and more.

All-in-one custom fundraising software to raise funds quickly & easily and take your nonprofit donations to the next level.

Features

- Custom Donation Forms

- Contact & Volunteer Forms

- Custom Landing Pages

- Donor Management CRM

- Flexible Payment Processing

- Own Your Data

- Languages

- Security

Contact

- Company Info

- Support

- Sales

- Status

- Privacy

- Terms

- Contact Us

© 2024 – GivingX – All rights reserved